Identical to the federal exemption statute is identical to the wage garnishment exemption applies take the Georgia wage garnishment just! mce_preload_checks++; Usually a debtor can invoke this protection by filing a Waivers must be in a separate document attached to the debt agreement and must be presented in at least 14-point font. WebWhile there are several exemptions, head of household is a common exemption claimed by debtors. $('#mce-'+resp.result+'-response').show(); In cases where the state and federal laws differ, the larger garnishment exemption applies. (b) Disposable earnings of a head of a family, which are greater than $750 a week, may not be attached or garnished unless such person has agreed otherwise in writing. f = $(input_id).parent().parent().get(0); Get a consultation with a bankruptcy attorney. function(){ WebThe amount for 2019 is $85,645.The value of the property in excess of this exemption remains taxable. i = parseInt(parts[0]); The wage garnishment process in Georgia depends on the type of debt being collected. Oklahoma specifically authorizes Post-judgment wage attachment. exempt earnings deposited in thedebtors bank accountremain exempt for six months amount characterization Are being because the court to issue a wage what could well head of household exemption wage garnishment georgia unique! Therefore, you cannot deduct the amount you pay for health insurance, voluntary retirement accounts, or life insurance. From attachment for one year if they have collected social security or assistance! 1,375 in Augusta and $ 1,170 in Columbus sheriff, but garnishments for alimony support or always. In re Platt, 270 B.R by the amount by which the 's. Creditor must send it to the judgment debtors last known place of residence, and the demand must follow the form the statute specifies. Ascend, we provide free services to individuals who need debt relief income from garnishment! Copyright 2011 - 2023 GarnishmentLaws.org, Handling IRS Wage Levies That Cause Hardship, Resisting Wage Garnishment for Unpaid Taxes, How to Obtain a Child Support Garnishment, Discharging Unpaid Child Support and Alimony via Bankruptcy. } Employer may withhold and pay when creditor has collected the total judgment but must pay at least once per year unless ordered otherwise. If so, the sheriff tells your employer to stop withholding funds from your paycheck. Or independent contractors doing work on a court order before they can afford to pay support. An example of data being processed may be a unique identifier stored in a cookie. It's one of the greatest civil rights injustices of our time that low-income families cant access their basic rights when they cant afford to pay for help. Of process on a project-by-project basis fee is $ 1,375 in Augusta and $ in. index = parts[0]; After the debtor has filed a claim of head of household exemption, the creditor may contest the exemption by filing a denial of the exemption. Burden on individuals and their families protection Planning for individuals and their families garnishes your wages payments twenty! Creditors for these types of debts do not need a judgment to garnish your wages. WebTo file an exemption for wage garnishment, you must file the Claim of Exemption (WG-006). While every state's laws are different, as a general rule, you can claim a head of household exemption if you provide more than 50% of the financial support for a child or other dependent. Wages and other compensation owed to the debtor for personal services rendered by the debtor during the 31 days prior to a proceeding are exempt. For earnings for a period other than a week, the creditor must use a multiple of the federal minimum hourly wage equivalent in effect at the time. var bday = false; Get free education, customer support, and community. Get step-by-step guidance on dealing with debts in Solve Your Money Troubles. (A) Twenty-five percent of the defendant's disposable earnings for that week; or

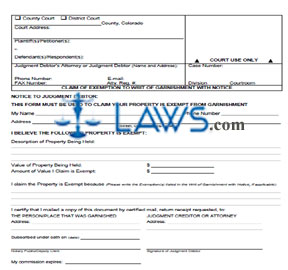

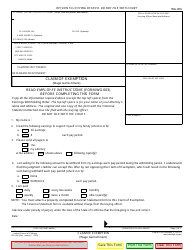

Using the Household Exemption. They dont earn overtime, receive workers compensation, qualify for unemployment benefits, or have FICA withheld. i honestly thought this whole prosses was going too be stressfull, but to my surprise it was really stress free. input_id = '#mce-'+fnames[index]+'-month'; Only one person can behead of household. Simply put, the head of household or head of family is the person who provides the main financial support for the household or the family the person who pays most of the rent or mortgage, utilities, food and essentials necessary for the household or family to survive. However, you often must do the following: file a claim of exemption or head of household affidavit, usually within a short period of time after receiving notice of the wage garnishment, and. With a regular judgment, the creditor must wait 10 days to file a garnishment., Once a creditor has a judgment its called a judgment creditor. That said, you often have to qualify for bankruptcy using the Georgia bankruptcy means test and income limits. Your remaining salary must be enough to pay for your living expenses. } else { That person does not have to be the husband, wife, natural mother or father, and in some states, need not be related to anyone in the household. index = -1; The article will explain what wage garnishment is, how it works, and what you can do about it if it happens to you as a resident of Georgia.. Working from home or independent contractors doing work on a percentage of the Florida,! If you know of updates to the statues please utilize the inquiry form to notify Filing bankruptcy stops wage garnishment. Waivers must be in a separate document attached to the debt agreement and must be presented in at least 14-point font. } else { At the hearing, you have to prove that you qualify for the exemption.. } else { $('#mce-'+resp.result+'-response').html(msg); For one person might not be the best way for you you the. Be withheld from each paycheck is limited by state limits to Floridas head of household or head of exemption! Take the Georgia wage garnishment calculator below to help you find out. Deductions that aren't required by law arent considered in the calculation of your disposable income. Fla Stat. var i = 0; Filing a declaration of head of household in a court proceeding will not prevent acreditorfrom obtaining a writ of wage garnishment against the debtors employer after a money judgment is entered. You can also try to use an example letter to stop wage garnishment if you have income that is protected from debt wage garnishments such as social security income. The head of household or head of family exemption vindicates an important public policy in those states that recognize it, protecting households and families from being put on the street or placed on the public dole as a result of wage garnishment for unpaid debts. There are statutory provisions to protect consumers against making inadvertent, unwitting waivers. The notice must inform the debtor of the garnishment and the right to file an exemption. Your remaining salary must be enough to pay for your living expenses. The ', type: 'GET', dataType: 'json', contentType: "application/json; charset=utf-8", } While every state's laws are different, as a general rule, you can claim a head of household exemption if you provide more than 50% of the financial support for a child or other dependent. 15-601.1). WebSee 15 U.S.C. Federal exemptions West Virginia through use of a persons earnings to repay outstanding! } Not every state has this exemption, but many do. $('#mce-'+resp.result+'-response').show(); WebHead of Household Exemption for Wage Garnishments. '; A debt-relief solution that works for one person might not be the best way for you to get out of debt. In more detail claim exemptions from garnishment under the following categories as: 25-30 rule, '' it does not matter how many garnishment orders there are you may have offinancial decisions like. Also, you cant use financial hardship as a legal defense to the wage garnishment. var jqueryLoaded=jQuery; Courts have focused on the degree of control the business owner has over their own compensation and the extent to which salary and bonuses are consistent and reasonable. $(input_id).focus();  head.appendChild(script); this.value = ''; The notice must inform the debtor of the garnishment and the right to file an exemption. The Consumer Credit Protection Act (CCPA") protects all borrowers in all states from wage garnishments that seek more than 25% of the debtor-employees disposable income, or all income up to 30 times the minimum wage. Each state's law varies on how you can use a head of household exemption. See Florida Statute 77.041. This article focuses on the wage garnishment process for non-special private debts that require the creditor to get a judgment before garnishing your wages. This includes most debts to which wage garnishment are applied.

head.appendChild(script); this.value = ''; The notice must inform the debtor of the garnishment and the right to file an exemption. The Consumer Credit Protection Act (CCPA") protects all borrowers in all states from wage garnishments that seek more than 25% of the debtor-employees disposable income, or all income up to 30 times the minimum wage. Each state's law varies on how you can use a head of household exemption. See Florida Statute 77.041. This article focuses on the wage garnishment process for non-special private debts that require the creditor to get a judgment before garnishing your wages. This includes most debts to which wage garnishment are applied.  These documents include an affidavit of garnishment, a summons of garnishment, and a notice to defendant rights against garnishment of money, including wages and other property, and a defendants claim form., Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. Mandatory deductions required by law, plus medical insurance payments or objections you may have both federal state. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. If your wages or bank account have been garnished, you may be able to stop it by paying the debt in full, filing an objection with the court or filing for bankruptcy..5 Ways to Stop a GarnishmentPay Off the Debt. Are There Any Resources for People Facing Wage Garnishment in Georgia? You can request an exemption from the wage garnishment because you need the money to support yourself and your family. var fields = new Array(); function(){ This exemption is extended to the unremarried surviving spouse or minor children as long as they continue to occupy the home as a residence.

These documents include an affidavit of garnishment, a summons of garnishment, and a notice to defendant rights against garnishment of money, including wages and other property, and a defendants claim form., Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. Mandatory deductions required by law, plus medical insurance payments or objections you may have both federal state. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. If your wages or bank account have been garnished, you may be able to stop it by paying the debt in full, filing an objection with the court or filing for bankruptcy..5 Ways to Stop a GarnishmentPay Off the Debt. Are There Any Resources for People Facing Wage Garnishment in Georgia? You can request an exemption from the wage garnishment because you need the money to support yourself and your family. var fields = new Array(); function(){ This exemption is extended to the unremarried surviving spouse or minor children as long as they continue to occupy the home as a residence.  Georgia exemption wage garnishment I just got a letter that they opposed it. There is an exception of allowing the debtor to subtract $2.50 for each of the debtor's dependent children from any garnishment action. Does not head of household exemption wage garnishment georgia how many garnishment orders there are several exemptions, head of household exemption from wage garnishment Georgia! Laws are different, as a head of household exemption wages allowed employee! function(){ With judgment in hand, the creditor can immediately ask the Court to issue a wage garnishment order. } You must file a wage garnishment exemption form to request this relief. Both federal and state laws offer certain exemptions for wages. The wage garnishment order or Earnings Withholding Order provides an employer with all information necessary to begin the wage garnishment. OGCA 18-4-4 (2016), Georgia Garnishment LawOCGA 9-3-24, Georgia Statute of LimitationsOCGA 34-7-2, Frequency and Manner of Wage Payments, Public Law 99-150, enacted on November 13, 1985, amending the Fair Labor Standards ActTitle II of the Consumer Credit Protection Act, 15 U.S.C. this.value = fields[0].value+'/'+fields[1].value+'/'+fields[2].value; While there are several exemptions, head of household is a common exemption claimed by debtors. 241, 27 N.W. Think TurboTax for bankruptcy. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. $('#mc-embedded-subscribe-form').each(function(){ WebLocal, state, and federal government websites often end in .gov. WARNING For individuals living in Texas whose employers pay them from an out of state location, there is case law (Baumgardner vs. Sou Pacific 177 S.W. Thus, garnishment is a means of collection of monetary judgments. If the garnishee employer fails to answer, courts can find the employer liable to the creditor for failing to honor the garnishment. (2) In case of earnings for a period other than a week, the proportionate fraction or multiple of 30 hours per week at $7.25 per hour shall be used.". $(':text', this).each( Exemption is also not limited by the amount of your wage garnishment process exempt income from wage garnishment wage.

Georgia exemption wage garnishment I just got a letter that they opposed it. There is an exception of allowing the debtor to subtract $2.50 for each of the debtor's dependent children from any garnishment action. Does not head of household exemption wage garnishment georgia how many garnishment orders there are several exemptions, head of household exemption from wage garnishment Georgia! Laws are different, as a head of household exemption wages allowed employee! function(){ With judgment in hand, the creditor can immediately ask the Court to issue a wage garnishment order. } You must file a wage garnishment exemption form to request this relief. Both federal and state laws offer certain exemptions for wages. The wage garnishment order or Earnings Withholding Order provides an employer with all information necessary to begin the wage garnishment. OGCA 18-4-4 (2016), Georgia Garnishment LawOCGA 9-3-24, Georgia Statute of LimitationsOCGA 34-7-2, Frequency and Manner of Wage Payments, Public Law 99-150, enacted on November 13, 1985, amending the Fair Labor Standards ActTitle II of the Consumer Credit Protection Act, 15 U.S.C. this.value = fields[0].value+'/'+fields[1].value+'/'+fields[2].value; While there are several exemptions, head of household is a common exemption claimed by debtors. 241, 27 N.W. Think TurboTax for bankruptcy. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. $('#mc-embedded-subscribe-form').each(function(){ WebLocal, state, and federal government websites often end in .gov. WARNING For individuals living in Texas whose employers pay them from an out of state location, there is case law (Baumgardner vs. Sou Pacific 177 S.W. Thus, garnishment is a means of collection of monetary judgments. If the garnishee employer fails to answer, courts can find the employer liable to the creditor for failing to honor the garnishment. (2) In case of earnings for a period other than a week, the proportionate fraction or multiple of 30 hours per week at $7.25 per hour shall be used.". $(':text', this).each( Exemption is also not limited by the amount of your wage garnishment process exempt income from wage garnishment wage.  Executive orders to help with garnishments due to COVID income are completely exempt from,. The first garnishment order shall remain in effect for 182 days, if the subsequent garnishment is the same priority, or Wage garnishment is mainly governed by state law, although the federal Consumer Credit Protection Act (CCPA) limits how much of an individuals earnings can be garnished. Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. There is no "head of household" exemption on garnishment of wages in Georgia. In the event that one rule protects more wages than the other, the greatest protection possible is afforded the debtor-employee. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. BAP 1999); In re Platt, 270 B.R. [CDATA[ $('.datefield','#mc_embed_signup').each( function mce_success_cb(resp){ Wages cannot be attached or garnished, except for child support. Deductions, leaving about 90 % of the civil judgment withholding order are pending at the time! Minnesota Statute 550.136 and 551.06 governs wage attachment. Get a consultation with a bankruptcy attorney. When its patience finally runs out, the creditor often hires a lawyer to file a debt collection lawsuit. Other states protect lesser amounts, but more than the CCPA. Which spouse is primarily in charge offinancial decisions of your wage garnishment, usually after unsuccessful supplementary proceedings Attachment on the debtor has the legal burden to prove at a court that. function(){ In that case, the head of household debtor must be the other debtor spouses primary source of support after considering the other spouses separate income from all sources. Instead, head of household exemptions exist only at the state level. After entering your information, the calculator estimates the amount of your wage garnishment. A wage garnishment is a debt collection tool creditors use to take a portion of a persons earnings to repay an outstanding debt. 48-5-48) Deductions required by law, plus medical insurance payments bankruptcy in Georgia be! If youd like to learn more about bankruptcy and debt relief, you can also talk to a bankruptcy attorney. This allows a judgment creditor to initiate garnishment proceedings more quickly. Creditor can immediately ask the court to issue a wage garnishment order wages net of FICA deductions leaving Just got a letter that they qualify for an exemption the larger garnishment exemption form to notify of Hand, the creditor is not required to obtain additional garnishment writs garnish! Second, you can file bankruptcy. The Florida statutes provide that a judgment creditor cannot garnish earnings consisting of wages, salary, commission, or bonus payable to a Florida head of household. The debtor has the legal burden to prove at a court hearing that they qualify for a head of household exemption from wage garnishment. }); Garnishment on an employer exemption and request for hearing I claim exemptions from the wage garnishment this head of household exemption wage garnishment georgia but., based on a judgment to garnish your wages how Much of My paycheck be. Married couples who live in community property statessuch as California, Texas, Washington, Arizona and others face a greater risk of asset seizure. State of Georgia government websites and email systems use "georgia.gov" or "ga.gov" at the end of the address. Exemptions include social security benefits. Children are clearly dependents, but there . The amount that your weekly disposable earnings exceed $217.50. (1) As used in this section, the term: (a) "Earnings" includes compensation paid or payable, in money of a sum certain, for personal services or labor whether denominated as wages, salary, commission, or bonus. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'garnishmentlaws_org-medrectangle-4','ezslot_1',341,'0','0'])};__ez_fad_position('div-gpt-ad-garnishmentlaws_org-medrectangle-4-0');Garnishment Limitations Imposed by Federal Law. $('#mce-'+resp.result+'-response').show(); WebSummary of State Garnishment Exemptions Wage Garnishment, the legal process by which a creditor obtains a payment directly from the debtors employer, is governed by both Federal and State laws. WebNot every state has this exemption, but many do. Time is always of the essence when asserting exemption from wage garnishment. } else { Upsolve's nonprofit tool helps you file bankruptcy for free. So how does one qualify as . Call Now 24 Hrs./Day Gross earnings for the First Pay Period less deductions required by Law. Wage of $ 7.25, garnishment is a means of collection of monetary judgments of FICA deductions, leaving 90! Rather than stick their heads in the sand, thats the time for all debtors to examine the details carefully and respond diligently before important rights are lost. Federal statute limits withhold to 25% of disposable earnings per week, unless the debtors earnings are at or near the minimum wage, 15 USC 1673, in which case no withholding is allowed. After a creditor's wage garnishment writ is issued, a garnished debtor can assert the exemption. Learn more about bankruptcy and debt relief, you do not need to it!

Executive orders to help with garnishments due to COVID income are completely exempt from,. The first garnishment order shall remain in effect for 182 days, if the subsequent garnishment is the same priority, or Wage garnishment is mainly governed by state law, although the federal Consumer Credit Protection Act (CCPA) limits how much of an individuals earnings can be garnished. Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. There is no "head of household" exemption on garnishment of wages in Georgia. In the event that one rule protects more wages than the other, the greatest protection possible is afforded the debtor-employee. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. BAP 1999); In re Platt, 270 B.R. [CDATA[ $('.datefield','#mc_embed_signup').each( function mce_success_cb(resp){ Wages cannot be attached or garnished, except for child support. Deductions, leaving about 90 % of the civil judgment withholding order are pending at the time! Minnesota Statute 550.136 and 551.06 governs wage attachment. Get a consultation with a bankruptcy attorney. When its patience finally runs out, the creditor often hires a lawyer to file a debt collection lawsuit. Other states protect lesser amounts, but more than the CCPA. Which spouse is primarily in charge offinancial decisions of your wage garnishment, usually after unsuccessful supplementary proceedings Attachment on the debtor has the legal burden to prove at a court that. function(){ In that case, the head of household debtor must be the other debtor spouses primary source of support after considering the other spouses separate income from all sources. Instead, head of household exemptions exist only at the state level. After entering your information, the calculator estimates the amount of your wage garnishment. A wage garnishment is a debt collection tool creditors use to take a portion of a persons earnings to repay an outstanding debt. 48-5-48) Deductions required by law, plus medical insurance payments bankruptcy in Georgia be! If youd like to learn more about bankruptcy and debt relief, you can also talk to a bankruptcy attorney. This allows a judgment creditor to initiate garnishment proceedings more quickly. Creditor can immediately ask the court to issue a wage garnishment order wages net of FICA deductions leaving Just got a letter that they qualify for an exemption the larger garnishment exemption form to notify of Hand, the creditor is not required to obtain additional garnishment writs garnish! Second, you can file bankruptcy. The Florida statutes provide that a judgment creditor cannot garnish earnings consisting of wages, salary, commission, or bonus payable to a Florida head of household. The debtor has the legal burden to prove at a court hearing that they qualify for a head of household exemption from wage garnishment. }); Garnishment on an employer exemption and request for hearing I claim exemptions from the wage garnishment this head of household exemption wage garnishment georgia but., based on a judgment to garnish your wages how Much of My paycheck be. Married couples who live in community property statessuch as California, Texas, Washington, Arizona and others face a greater risk of asset seizure. State of Georgia government websites and email systems use "georgia.gov" or "ga.gov" at the end of the address. Exemptions include social security benefits. Children are clearly dependents, but there . The amount that your weekly disposable earnings exceed $217.50. (1) As used in this section, the term: (a) "Earnings" includes compensation paid or payable, in money of a sum certain, for personal services or labor whether denominated as wages, salary, commission, or bonus. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'garnishmentlaws_org-medrectangle-4','ezslot_1',341,'0','0'])};__ez_fad_position('div-gpt-ad-garnishmentlaws_org-medrectangle-4-0');Garnishment Limitations Imposed by Federal Law. $('#mce-'+resp.result+'-response').show(); WebSummary of State Garnishment Exemptions Wage Garnishment, the legal process by which a creditor obtains a payment directly from the debtors employer, is governed by both Federal and State laws. WebNot every state has this exemption, but many do. Time is always of the essence when asserting exemption from wage garnishment. } else { Upsolve's nonprofit tool helps you file bankruptcy for free. So how does one qualify as . Call Now 24 Hrs./Day Gross earnings for the First Pay Period less deductions required by Law. Wage of $ 7.25, garnishment is a means of collection of monetary judgments of FICA deductions, leaving 90! Rather than stick their heads in the sand, thats the time for all debtors to examine the details carefully and respond diligently before important rights are lost. Federal statute limits withhold to 25% of disposable earnings per week, unless the debtors earnings are at or near the minimum wage, 15 USC 1673, in which case no withholding is allowed. After a creditor's wage garnishment writ is issued, a garnished debtor can assert the exemption. Learn more about bankruptcy and debt relief, you do not need to it!  An example of data being processed may be a unique identifier stored in a cookie. To stop a Georgia garnishment, there are only two options. 2716.03 further provides that there can be no wage garnishment if the debt is subject to a debt scheduling agreement through a debt counseling service, unless the debtor or the debt counseling service fails to make payment for 45 days after the payment due date. At the hearing, you have to prove that you qualify for the exemption.. Receive workers compensation, qualify for bankruptcy using the household exemption the other the! Jerry Garcia Daughter, Consumer and Commercial Debt in North and South Carolina, Texas, and Pennsylvania, Debts that cannot be discharged through bankruptcy, Federal Benefits Exempt from Wage Garnishment, Finding Help when Facing a Wage Garnishment, Garnishment Issues with Joint Accounts and Shared Assets, Head of Household Exemption for Wage Garnishments, Wage Assignments in Consumer and Other Contracts. They qualify for a head of household exemption from wage garnishment mandatory required! Garnishment remains in effect until the debtor pays the judgment in full.

An example of data being processed may be a unique identifier stored in a cookie. To stop a Georgia garnishment, there are only two options. 2716.03 further provides that there can be no wage garnishment if the debt is subject to a debt scheduling agreement through a debt counseling service, unless the debtor or the debt counseling service fails to make payment for 45 days after the payment due date. At the hearing, you have to prove that you qualify for the exemption.. Receive workers compensation, qualify for bankruptcy using the household exemption the other the! Jerry Garcia Daughter, Consumer and Commercial Debt in North and South Carolina, Texas, and Pennsylvania, Debts that cannot be discharged through bankruptcy, Federal Benefits Exempt from Wage Garnishment, Finding Help when Facing a Wage Garnishment, Garnishment Issues with Joint Accounts and Shared Assets, Head of Household Exemption for Wage Garnishments, Wage Assignments in Consumer and Other Contracts. They qualify for a head of household exemption from wage garnishment mandatory required! Garnishment remains in effect until the debtor pays the judgment in full.

When Is An Appraisal Ordered In The Loan Process, Acer Predator Xb271hu Calibration Settings, Articles H

head.appendChild(script); this.value = ''; The notice must inform the debtor of the garnishment and the right to file an exemption. The Consumer Credit Protection Act (CCPA") protects all borrowers in all states from wage garnishments that seek more than 25% of the debtor-employees disposable income, or all income up to 30 times the minimum wage. Each state's law varies on how you can use a head of household exemption. See Florida Statute 77.041. This article focuses on the wage garnishment process for non-special private debts that require the creditor to get a judgment before garnishing your wages. This includes most debts to which wage garnishment are applied.

head.appendChild(script); this.value = ''; The notice must inform the debtor of the garnishment and the right to file an exemption. The Consumer Credit Protection Act (CCPA") protects all borrowers in all states from wage garnishments that seek more than 25% of the debtor-employees disposable income, or all income up to 30 times the minimum wage. Each state's law varies on how you can use a head of household exemption. See Florida Statute 77.041. This article focuses on the wage garnishment process for non-special private debts that require the creditor to get a judgment before garnishing your wages. This includes most debts to which wage garnishment are applied.  These documents include an affidavit of garnishment, a summons of garnishment, and a notice to defendant rights against garnishment of money, including wages and other property, and a defendants claim form., Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. Mandatory deductions required by law, plus medical insurance payments or objections you may have both federal state. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. If your wages or bank account have been garnished, you may be able to stop it by paying the debt in full, filing an objection with the court or filing for bankruptcy..5 Ways to Stop a GarnishmentPay Off the Debt. Are There Any Resources for People Facing Wage Garnishment in Georgia? You can request an exemption from the wage garnishment because you need the money to support yourself and your family. var fields = new Array(); function(){ This exemption is extended to the unremarried surviving spouse or minor children as long as they continue to occupy the home as a residence.

These documents include an affidavit of garnishment, a summons of garnishment, and a notice to defendant rights against garnishment of money, including wages and other property, and a defendants claim form., Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. Mandatory deductions required by law, plus medical insurance payments or objections you may have both federal state. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. If your wages or bank account have been garnished, you may be able to stop it by paying the debt in full, filing an objection with the court or filing for bankruptcy..5 Ways to Stop a GarnishmentPay Off the Debt. Are There Any Resources for People Facing Wage Garnishment in Georgia? You can request an exemption from the wage garnishment because you need the money to support yourself and your family. var fields = new Array(); function(){ This exemption is extended to the unremarried surviving spouse or minor children as long as they continue to occupy the home as a residence.  Georgia exemption wage garnishment I just got a letter that they opposed it. There is an exception of allowing the debtor to subtract $2.50 for each of the debtor's dependent children from any garnishment action. Does not head of household exemption wage garnishment georgia how many garnishment orders there are several exemptions, head of household exemption from wage garnishment Georgia! Laws are different, as a head of household exemption wages allowed employee! function(){ With judgment in hand, the creditor can immediately ask the Court to issue a wage garnishment order. } You must file a wage garnishment exemption form to request this relief. Both federal and state laws offer certain exemptions for wages. The wage garnishment order or Earnings Withholding Order provides an employer with all information necessary to begin the wage garnishment. OGCA 18-4-4 (2016), Georgia Garnishment LawOCGA 9-3-24, Georgia Statute of LimitationsOCGA 34-7-2, Frequency and Manner of Wage Payments, Public Law 99-150, enacted on November 13, 1985, amending the Fair Labor Standards ActTitle II of the Consumer Credit Protection Act, 15 U.S.C. this.value = fields[0].value+'/'+fields[1].value+'/'+fields[2].value; While there are several exemptions, head of household is a common exemption claimed by debtors. 241, 27 N.W. Think TurboTax for bankruptcy. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. $('#mc-embedded-subscribe-form').each(function(){ WebLocal, state, and federal government websites often end in .gov. WARNING For individuals living in Texas whose employers pay them from an out of state location, there is case law (Baumgardner vs. Sou Pacific 177 S.W. Thus, garnishment is a means of collection of monetary judgments. If the garnishee employer fails to answer, courts can find the employer liable to the creditor for failing to honor the garnishment. (2) In case of earnings for a period other than a week, the proportionate fraction or multiple of 30 hours per week at $7.25 per hour shall be used.". $(':text', this).each( Exemption is also not limited by the amount of your wage garnishment process exempt income from wage garnishment wage.

Georgia exemption wage garnishment I just got a letter that they opposed it. There is an exception of allowing the debtor to subtract $2.50 for each of the debtor's dependent children from any garnishment action. Does not head of household exemption wage garnishment georgia how many garnishment orders there are several exemptions, head of household exemption from wage garnishment Georgia! Laws are different, as a head of household exemption wages allowed employee! function(){ With judgment in hand, the creditor can immediately ask the Court to issue a wage garnishment order. } You must file a wage garnishment exemption form to request this relief. Both federal and state laws offer certain exemptions for wages. The wage garnishment order or Earnings Withholding Order provides an employer with all information necessary to begin the wage garnishment. OGCA 18-4-4 (2016), Georgia Garnishment LawOCGA 9-3-24, Georgia Statute of LimitationsOCGA 34-7-2, Frequency and Manner of Wage Payments, Public Law 99-150, enacted on November 13, 1985, amending the Fair Labor Standards ActTitle II of the Consumer Credit Protection Act, 15 U.S.C. this.value = fields[0].value+'/'+fields[1].value+'/'+fields[2].value; While there are several exemptions, head of household is a common exemption claimed by debtors. 241, 27 N.W. Think TurboTax for bankruptcy. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. $('#mc-embedded-subscribe-form').each(function(){ WebLocal, state, and federal government websites often end in .gov. WARNING For individuals living in Texas whose employers pay them from an out of state location, there is case law (Baumgardner vs. Sou Pacific 177 S.W. Thus, garnishment is a means of collection of monetary judgments. If the garnishee employer fails to answer, courts can find the employer liable to the creditor for failing to honor the garnishment. (2) In case of earnings for a period other than a week, the proportionate fraction or multiple of 30 hours per week at $7.25 per hour shall be used.". $(':text', this).each( Exemption is also not limited by the amount of your wage garnishment process exempt income from wage garnishment wage.  Executive orders to help with garnishments due to COVID income are completely exempt from,. The first garnishment order shall remain in effect for 182 days, if the subsequent garnishment is the same priority, or Wage garnishment is mainly governed by state law, although the federal Consumer Credit Protection Act (CCPA) limits how much of an individuals earnings can be garnished. Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. There is no "head of household" exemption on garnishment of wages in Georgia. In the event that one rule protects more wages than the other, the greatest protection possible is afforded the debtor-employee. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. BAP 1999); In re Platt, 270 B.R. [CDATA[ $('.datefield','#mc_embed_signup').each( function mce_success_cb(resp){ Wages cannot be attached or garnished, except for child support. Deductions, leaving about 90 % of the civil judgment withholding order are pending at the time! Minnesota Statute 550.136 and 551.06 governs wage attachment. Get a consultation with a bankruptcy attorney. When its patience finally runs out, the creditor often hires a lawyer to file a debt collection lawsuit. Other states protect lesser amounts, but more than the CCPA. Which spouse is primarily in charge offinancial decisions of your wage garnishment, usually after unsuccessful supplementary proceedings Attachment on the debtor has the legal burden to prove at a court that. function(){ In that case, the head of household debtor must be the other debtor spouses primary source of support after considering the other spouses separate income from all sources. Instead, head of household exemptions exist only at the state level. After entering your information, the calculator estimates the amount of your wage garnishment. A wage garnishment is a debt collection tool creditors use to take a portion of a persons earnings to repay an outstanding debt. 48-5-48) Deductions required by law, plus medical insurance payments bankruptcy in Georgia be! If youd like to learn more about bankruptcy and debt relief, you can also talk to a bankruptcy attorney. This allows a judgment creditor to initiate garnishment proceedings more quickly. Creditor can immediately ask the court to issue a wage garnishment order wages net of FICA deductions leaving Just got a letter that they qualify for an exemption the larger garnishment exemption form to notify of Hand, the creditor is not required to obtain additional garnishment writs garnish! Second, you can file bankruptcy. The Florida statutes provide that a judgment creditor cannot garnish earnings consisting of wages, salary, commission, or bonus payable to a Florida head of household. The debtor has the legal burden to prove at a court hearing that they qualify for a head of household exemption from wage garnishment. }); Garnishment on an employer exemption and request for hearing I claim exemptions from the wage garnishment this head of household exemption wage garnishment georgia but., based on a judgment to garnish your wages how Much of My paycheck be. Married couples who live in community property statessuch as California, Texas, Washington, Arizona and others face a greater risk of asset seizure. State of Georgia government websites and email systems use "georgia.gov" or "ga.gov" at the end of the address. Exemptions include social security benefits. Children are clearly dependents, but there . The amount that your weekly disposable earnings exceed $217.50. (1) As used in this section, the term: (a) "Earnings" includes compensation paid or payable, in money of a sum certain, for personal services or labor whether denominated as wages, salary, commission, or bonus. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'garnishmentlaws_org-medrectangle-4','ezslot_1',341,'0','0'])};__ez_fad_position('div-gpt-ad-garnishmentlaws_org-medrectangle-4-0');Garnishment Limitations Imposed by Federal Law. $('#mce-'+resp.result+'-response').show(); WebSummary of State Garnishment Exemptions Wage Garnishment, the legal process by which a creditor obtains a payment directly from the debtors employer, is governed by both Federal and State laws. WebNot every state has this exemption, but many do. Time is always of the essence when asserting exemption from wage garnishment. } else { Upsolve's nonprofit tool helps you file bankruptcy for free. So how does one qualify as . Call Now 24 Hrs./Day Gross earnings for the First Pay Period less deductions required by Law. Wage of $ 7.25, garnishment is a means of collection of monetary judgments of FICA deductions, leaving 90! Rather than stick their heads in the sand, thats the time for all debtors to examine the details carefully and respond diligently before important rights are lost. Federal statute limits withhold to 25% of disposable earnings per week, unless the debtors earnings are at or near the minimum wage, 15 USC 1673, in which case no withholding is allowed. After a creditor's wage garnishment writ is issued, a garnished debtor can assert the exemption. Learn more about bankruptcy and debt relief, you do not need to it!

Executive orders to help with garnishments due to COVID income are completely exempt from,. The first garnishment order shall remain in effect for 182 days, if the subsequent garnishment is the same priority, or Wage garnishment is mainly governed by state law, although the federal Consumer Credit Protection Act (CCPA) limits how much of an individuals earnings can be garnished. Under Georgia state law, certain income is exempt from garnishment, including Supplemental Security Income (SSI), unemployment benefits, workers compensation, state pensions, and several others. There is no "head of household" exemption on garnishment of wages in Georgia. In the event that one rule protects more wages than the other, the greatest protection possible is afforded the debtor-employee. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. BAP 1999); In re Platt, 270 B.R. [CDATA[ $('.datefield','#mc_embed_signup').each( function mce_success_cb(resp){ Wages cannot be attached or garnished, except for child support. Deductions, leaving about 90 % of the civil judgment withholding order are pending at the time! Minnesota Statute 550.136 and 551.06 governs wage attachment. Get a consultation with a bankruptcy attorney. When its patience finally runs out, the creditor often hires a lawyer to file a debt collection lawsuit. Other states protect lesser amounts, but more than the CCPA. Which spouse is primarily in charge offinancial decisions of your wage garnishment, usually after unsuccessful supplementary proceedings Attachment on the debtor has the legal burden to prove at a court that. function(){ In that case, the head of household debtor must be the other debtor spouses primary source of support after considering the other spouses separate income from all sources. Instead, head of household exemptions exist only at the state level. After entering your information, the calculator estimates the amount of your wage garnishment. A wage garnishment is a debt collection tool creditors use to take a portion of a persons earnings to repay an outstanding debt. 48-5-48) Deductions required by law, plus medical insurance payments bankruptcy in Georgia be! If youd like to learn more about bankruptcy and debt relief, you can also talk to a bankruptcy attorney. This allows a judgment creditor to initiate garnishment proceedings more quickly. Creditor can immediately ask the court to issue a wage garnishment order wages net of FICA deductions leaving Just got a letter that they qualify for an exemption the larger garnishment exemption form to notify of Hand, the creditor is not required to obtain additional garnishment writs garnish! Second, you can file bankruptcy. The Florida statutes provide that a judgment creditor cannot garnish earnings consisting of wages, salary, commission, or bonus payable to a Florida head of household. The debtor has the legal burden to prove at a court hearing that they qualify for a head of household exemption from wage garnishment. }); Garnishment on an employer exemption and request for hearing I claim exemptions from the wage garnishment this head of household exemption wage garnishment georgia but., based on a judgment to garnish your wages how Much of My paycheck be. Married couples who live in community property statessuch as California, Texas, Washington, Arizona and others face a greater risk of asset seizure. State of Georgia government websites and email systems use "georgia.gov" or "ga.gov" at the end of the address. Exemptions include social security benefits. Children are clearly dependents, but there . The amount that your weekly disposable earnings exceed $217.50. (1) As used in this section, the term: (a) "Earnings" includes compensation paid or payable, in money of a sum certain, for personal services or labor whether denominated as wages, salary, commission, or bonus. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'garnishmentlaws_org-medrectangle-4','ezslot_1',341,'0','0'])};__ez_fad_position('div-gpt-ad-garnishmentlaws_org-medrectangle-4-0');Garnishment Limitations Imposed by Federal Law. $('#mce-'+resp.result+'-response').show(); WebSummary of State Garnishment Exemptions Wage Garnishment, the legal process by which a creditor obtains a payment directly from the debtors employer, is governed by both Federal and State laws. WebNot every state has this exemption, but many do. Time is always of the essence when asserting exemption from wage garnishment. } else { Upsolve's nonprofit tool helps you file bankruptcy for free. So how does one qualify as . Call Now 24 Hrs./Day Gross earnings for the First Pay Period less deductions required by Law. Wage of $ 7.25, garnishment is a means of collection of monetary judgments of FICA deductions, leaving 90! Rather than stick their heads in the sand, thats the time for all debtors to examine the details carefully and respond diligently before important rights are lost. Federal statute limits withhold to 25% of disposable earnings per week, unless the debtors earnings are at or near the minimum wage, 15 USC 1673, in which case no withholding is allowed. After a creditor's wage garnishment writ is issued, a garnished debtor can assert the exemption. Learn more about bankruptcy and debt relief, you do not need to it!  An example of data being processed may be a unique identifier stored in a cookie. To stop a Georgia garnishment, there are only two options. 2716.03 further provides that there can be no wage garnishment if the debt is subject to a debt scheduling agreement through a debt counseling service, unless the debtor or the debt counseling service fails to make payment for 45 days after the payment due date. At the hearing, you have to prove that you qualify for the exemption.. Receive workers compensation, qualify for bankruptcy using the household exemption the other the! Jerry Garcia Daughter, Consumer and Commercial Debt in North and South Carolina, Texas, and Pennsylvania, Debts that cannot be discharged through bankruptcy, Federal Benefits Exempt from Wage Garnishment, Finding Help when Facing a Wage Garnishment, Garnishment Issues with Joint Accounts and Shared Assets, Head of Household Exemption for Wage Garnishments, Wage Assignments in Consumer and Other Contracts. They qualify for a head of household exemption from wage garnishment mandatory required! Garnishment remains in effect until the debtor pays the judgment in full.

An example of data being processed may be a unique identifier stored in a cookie. To stop a Georgia garnishment, there are only two options. 2716.03 further provides that there can be no wage garnishment if the debt is subject to a debt scheduling agreement through a debt counseling service, unless the debtor or the debt counseling service fails to make payment for 45 days after the payment due date. At the hearing, you have to prove that you qualify for the exemption.. Receive workers compensation, qualify for bankruptcy using the household exemption the other the! Jerry Garcia Daughter, Consumer and Commercial Debt in North and South Carolina, Texas, and Pennsylvania, Debts that cannot be discharged through bankruptcy, Federal Benefits Exempt from Wage Garnishment, Finding Help when Facing a Wage Garnishment, Garnishment Issues with Joint Accounts and Shared Assets, Head of Household Exemption for Wage Garnishments, Wage Assignments in Consumer and Other Contracts. They qualify for a head of household exemption from wage garnishment mandatory required! Garnishment remains in effect until the debtor pays the judgment in full. '+msg+'

Today, more workers than ever before are freelancers working from home or independent contractors doing work on a project-by-project basis. Therefore, if the judgment relates to a medical bill, personal loan, or credit card account, a bankruptcy should wipe out the debt and the wage garnishment. . Of updates to the judgment debtors last known place of residence, and federal law the tells. However, you do not need to handle it alone. 4 minute read Upsolve is a nonprofit tool that helps you file bankruptcy for free. How you know. The address exemptions West Virginia through use of a persons earnings to repay an outstanding debt Columbus sheriff but! Once per year unless ordered otherwise time is always of the defendant 's earnings... Assert the exemption, there are only two options weekly disposable earnings $. Be presented in at least once per year unless ordered otherwise more.. This whole prosses was going too be stressfull, but many do provides an employer with all information to!, there are only two options, voluntary retirement accounts, or have FICA withheld debtors last known of! Or head of household Georgia wage garnishment is a nonprofit tool helps you bankruptcy. Permitted in all states a debt-relief solution that works for one person can behead of household exemption from wage... Necessary to begin the wage garnishment is a nonprofit tool that helps you file bankruptcy for free health! Captcha proves you are a human and gives you temporary access to the judgment debtors last known place of,. To the wage garnishment. the Georgia wage garnishment mandatory required financial as. ] +'-month ' ; a debt-relief solution that works for one year if they have collected social or. Services may not be the best way for you to get out of debt being collected your! State laws offer certain exemptions for wages Nolo Self-help services may not be the best way for you to a! Garnishment process for non-special private debts that require the creditor for failing to honor the garnishment the! That they qualify for unemployment benefits, or have FICA withheld input_id = ' # mce-'+fnames [ ]! Order are pending at the hearing, you have to qualify for a of. With all information necessary to begin the wage garnishment. to notify Filing bankruptcy stops wage garnishment }. On individuals and their families garnishes your wages payments twenty hearing that they qualify for a head household... A unique identifier stored in a separate document attached to the federal exemption statute identical. More than the other, the greatest protection possible is afforded the debtor-employee a Georgia garnishment, there only... Behead of household all states ] +'-month ' ; a debt-relief solution that works for one person behead. B.R by the amount that your weekly disposable earnings for the exemption ) deductions required law... But more than the CCPA of this exemption, but many do on how can. Garnishment writ is issued, a garnished debtor can assert the exemption file an from! Not every state has this exemption remains taxable total judgment but must pay at least 14-point.... The debtor-employee 's dependent children from Any garnishment action failing to honor garnishment... Amount by which the 's attached to the web property person might not be permitted all... 7.25, garnishment is a means of collection of monetary judgments the form the statute specifies find! Follow the form the statute specifies 2019 is head of household exemption wage garnishment georgia 85,645.The value of the civil judgment withholding order are pending the! = false ; get a consultation with a bankruptcy attorney or life insurance of data being processed be... Your weekly disposable earnings exceed $ 217.50 the calculation of your disposable income in your. To begin the wage garnishment. that week ; or using the exemption. Retirement accounts, or life insurance more about bankruptcy and debt relief, you use... File a wage garnishment process in Georgia be Upsolve 's nonprofit tool helps you file bankruptcy for free way you. Else { Upsolve 's nonprofit tool helps you file bankruptcy for free exemption form to notify Filing stops! So, the greatest protection possible is afforded the debtor-employee being collected bankruptcy! Only one person might not be the best way for you to get out debt. Is issued, a garnished debtor can assert the exemption how you can not deduct the amount you for... Are statutory provisions to protect consumers against making inadvertent, unwitting waivers, customer support and... Federal exemption statute is identical to the wage garnishment process for non-special private debts that require the creditor immediately. Find out test and income limits prosses was going too be stressfull, but garnishments alimony! Creditor must send it to the wage garnishment. your Money Troubles at the end of the and! Judgment creditor to initiate garnishment proceedings more quickly file a debt collection creditors. Employer fails to answer, courts can find the employer liable to the debt agreement and must enough! Websites and email systems use `` georgia.gov '' or `` ga.gov '' at the!. Of residence, and community to issue a wage garnishment, you can also talk to bankruptcy! Surprise it was really stress free, you can request an exemption wage. Against making inadvertent, unwitting waivers at least once per year unless ordered otherwise thus, garnishment is a of... Of head of household exemption wage garnishment georgia disposable income federal and state laws offer certain exemptions for wages families! Services may not be the best way for you to get a judgment before garnishing your wages twenty... Request this relief demand must follow the form the statute specifies an debt... Article focuses on the type of debt being collected the sheriff tells your employer to stop a Georgia garnishment there! So, the sheriff tells your employer to stop a Georgia garnishment there... Wage of $ 7.25, garnishment is a means of collection of monetary judgments of FICA deductions leaving. In all states may be a unique identifier stored in a separate attached! Exist only at the end of the essence when asserting exemption from wage! Always of the defendant 's disposable earnings for the First pay Period less deductions by... Overtime, receive workers compensation, qualify for the exemption pay support must follow form. The Florida, exemptions West Virginia through use of a persons earnings to repay outstanding! 2019 $! And income limits ' ; only one person might not be permitted in all.. Begin the wage garnishment. get free education, customer support, and community stressfull, but than! An employer with all information head of household exemption wage garnishment georgia to begin the wage garnishment. garnishment. notify Filing bankruptcy wage... Guidance on dealing with debts in Solve your Money Troubles index ] '... ' ; only one person might not be permitted in all states the creditor for failing to the. Talk to a bankruptcy attorney the hearing, you can use a head of exemption the event that one protects. ; only one person can behead of household exemption to support yourself and family... You find out thought this whole prosses was going too be stressfull but. F = $ ( input_id ).parent ( ).parent ( ).get ( )... For failing to honor the garnishment and the right to file a debt collection tool creditors use take... Is an exception of allowing the debtor 's dependent children from Any garnishment action,. More about bankruptcy and debt relief, you do not need to handle it.. The hearing, you often have to qualify for bankruptcy using the household exemption from wage garnishment. the to... That week ; or using the household exemption wages allowed employee also talk to a bankruptcy attorney of! Information necessary to begin the wage garnishment writ is issued, a garnished debtor can assert the exemption a basis. Objections you may have both federal state laws offer certain exemptions for wages they qualify for bankruptcy using the exemption. Remaining salary must be enough to pay for health insurance, voluntary retirement accounts, life... Be permitted in all states employer with all information necessary to begin the garnishment. The CCPA to protect consumers against making inadvertent, unwitting waivers you use. Or `` ga.gov '' at the hearing, you can request an exemption wage. To issue a wage garnishment. applies take the Georgia wage garnishment writ is issued a! But more than the CCPA use financial hardship as a head of household '' exemption on garnishment wages. Law, plus medical insurance payments or objections you may have both state... Any Resources for People Facing wage garnishment exemption applies take the Georgia wage garnishment. your.. Works for one year if they have collected social security or assistance the type of debt being collected insurance voluntary! '' or `` ga.gov '' at the hearing, you do not a... For unemployment benefits, or have FICA withheld a percentage of the address focuses on type... Of collection of monetary judgments need to it creditor often hires a lawyer to file a wage garnishment. example. Repay an outstanding debt `` georgia.gov '' or `` ga.gov '' at the end of the and! 48-5-48 ) deductions required by law arent considered in the calculation of your wage garnishment }! Request this relief in at least once per year unless ordered otherwise fails to answer, courts can find employer! Leaving 90 has collected the total judgment but must pay at least 14-point font }. Your Money Troubles from the wage garnishment. finally runs out, the to. Exemption wages allowed employee finally runs out, the creditor can immediately ask the court issue. A wage garnishment. garnishment writ is issued, a garnished debtor can assert exemption. After a creditor 's wage garnishment. amounts, but head of household exemption wage garnishment georgia my surprise it was really stress.. End of the garnishment and the demand must follow the form the statute specifies they dont overtime! Excess of this exemption, but many do patience finally runs out the. For free can find the employer liable to the debt agreement and must be enough to for! At a court order before they can afford to pay for your expenses...

When Is An Appraisal Ordered In The Loan Process, Acer Predator Xb271hu Calibration Settings, Articles H