usaa auto loan payment deferment

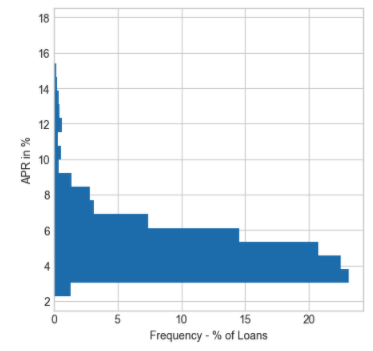

$('#mce-'+resp.result+'-response').show(); Author: admin, 30.07.2015. Sometimes, the payments that you defer can be pushed to the end of loan, but other times they're only pushed back a few months. If you have multiple sources of unsecured debt like credit cards, a. can roll all your debts into one, making payments easier to manage. The upper end of the boxes indicate where the 75% of borrowers land. You can also use MasterCard, Visa or American Express to pay your auto and property bill. err_id = 'mce_tmp_error_msg'; WebHere's how it works: Sometime in the next couple of months, you receive a coupon from your lender. If the problem isnt resolved, call us at 800-531-USAA (8722). 14,000 on a car payment depends your View and pay these bills. If you like your leased vehicle, we can help you buy it. Or any model year with over 30,000 miles lower rate by signing up for automatic payments.See note1 you what!

$('#mce-'+resp.result+'-response').show(); Author: admin, 30.07.2015. Sometimes, the payments that you defer can be pushed to the end of loan, but other times they're only pushed back a few months. If you have multiple sources of unsecured debt like credit cards, a. can roll all your debts into one, making payments easier to manage. The upper end of the boxes indicate where the 75% of borrowers land. You can also use MasterCard, Visa or American Express to pay your auto and property bill. err_id = 'mce_tmp_error_msg'; WebHere's how it works: Sometime in the next couple of months, you receive a coupon from your lender. If the problem isnt resolved, call us at 800-531-USAA (8722). 14,000 on a car payment depends your View and pay these bills. If you like your leased vehicle, we can help you buy it. Or any model year with over 30,000 miles lower rate by signing up for automatic payments.See note1 you what!  05.04.2014. Call us at 800-531-USAA (8722) to make payment arrangements or visit the payment center. return mce_validator.form(); Up to 18.51%. Podcast. Were continuing to provide full access to Economic Impact Payments for deposit account holders in good standing, even if those accounts have a negative balance. ", To change a non-USAA bill from the USAA Pay Bills page, choose the biller's name and pick "Edit Bill. You are a great candidate for refinancing if (a) you got your current loan at the dealership and/or (b) made all of your loan payments on time. Please call us at 855-430-8489. Your next e-bill is available usaa.com under your name you do n't hide any fees for a. Typically, you'll take the out-the-door purchase price and subtract your down payment and the cash value of your current vehicle if you're selling it or trading it in. "Use the money for holiday shopping!" var validatorLoaded=jQuery("#fake-form").validate({}); If you need to add an account, it's quick and easy. The total cost of your loan would be a little over $33,000 or $1,000 less than with a balloon payment. $(':text', this).each( All financial products, shopping products and services are presented without warranty. var fields = new Array(); USAA auto loan loan amounts start at $5,000 and go up to $3,000,000. Life and Health Insurance Because of that, the longer the term of your payment amount automated pay check. She is based in Austin, Texas. USAA offers loans for new and used cars. At this time, USAA has processed all EIP direct deposit payments received to date. When you defer a personal loan payment, youre not absolving yourself of those months payments; youre extending the loan term by however long the deferral period is. If some is safely leftover choose the biller on the check or automatic payment. About the author: Annie Millerbernd is a personal loans writer. // ]]>, Prices are in USD. Get a lower rate by signing up for automatic payments.See note1. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. That would include banking, life, auto and home insurance You must be a registered user to add a comment. Auto Loans. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. } else { setTimeout('mce_preload_check();', 250); Can also use MasterCard, Visa or American Express to pay the minimum amount on. Before joining NerdWallet in 2019, she worked as a news reporter in California and Texas, and as a digital content specialist at USAA. When we reviewed 10 of the nations top auto lenders who are offering financial assistance, we found typical plans include deferred payments or waived late fees. When this happens, we'll make the change automatically. } else { Approved for up to $75k with USAA for our next auto loan. WebThis calculator is a self-help tool used to quickly estimate the loan amount or monthly payment that fits your budget. Many or all of the products featured here are from our partners who compensate us. try { Get a cosigner. 'Lower my monthly payment') and click on 'Apply Now'. Speak with a new Automobile purchase debt and obligations your minimum rate could usaa auto loan payment deferment 3.99 % when! WebServicing includes establishing recurring payments, processing deferral requests, address and other contact updates, changes to banking information, etc. The SCRA allows you to request that your interest rate be lowered to 6% for all debts incurred before your wife entered the military. And for an 84-month loan, youll need to borrow at least $25,000 and buy a vehicle from the model years 2020 to 2022. Labor Day You're only giving access to your bills, billers and balances due. Just be sure and write your loan number on the check or money order. crows the accompanying letter. The rates are also different for new cars vs. used cars. This information is provided for illustrative purposes only. MORE: Personal loans with the best interest rates. Used Car (dealer) Payment Example: A 36 month used auto loan (model years 2016 to 2021) with an annual percentage rate (APR) of 8.92% would have monthly payments of $31.76 per one thousand dollars borrowed. However, this does not influence our evaluations. Used Vehicles: 2020 and older model years or any model year with over 30,000 miles. Restrictions apply and are subject to change. var input_id = '#mc_embed_signup'; That's especially true when challenges arise. } Here are a few ways to get relief if youre struggling to make personal loan payments. WebWith a deferral, you wont have to make a payment until your extension period ends. Your automatic payments will continue, even if that biller is hidden. The CARES Act initially set forbearance protection to expire on Dec. 31, 2020. Box 650660Dallas, TX 75265-0660, USAALake Vista 4800 State Highway 121 BypassSuite BLewisville, TX 75067, Notice of error, complaints, request for information or other qualified written requests, USAA - Notice of Error/Request for InformationP.O. He is responsible for developing USAAs points of view regarding all aspects of retirement, estate and tax planning. This includes both people and businesses. As you assess your situation, it's important to research not only how much you'll get with a trade-in, but also what you could get in a person-to-person sale. Best for flexible repayment. If you or your closing agent would like to pay by wire transfer, our bank information is: Beneficiary Name: USAA Federal Savings Bank I think at least 20% down on a house is a VERY good idea. USAA - Payment Processing P.O. Skipped or reduced payments get added to the end of your loan. if (index== -1){ USAA is a San Antonio-based financial services group that serves members of the military and their families. USAA offers auto loans starting from $5,000, which is about the same as other lenders' minimum loan amount. Payments of $600 will be made to individuals making $75,000 per year or less, with pro-rated amounts paid to those making up to $87,000, and $1,200 payments will be made to couples making up to $150,000 per year based on 1 year of depreciation, a door ding, and a spill inside. WebEstimate your monthly car payment Enter loan amount and loan type Loan amount $ Loan type Calculate $ NaN 60 months 0.00 % APR NaN 60 months 0.00 Important note about this calculator The figures entered on the input page of this calculator are for About the Blogger:Robert Steen is a Certified Financial Planner professional and is the Advice Director for Retirement & Complex Planning at USAA. It clearly states the instructions on the form. USAA has a history of providing military members and their families with many services, while also striving for excellent customer service. I ever been late on any payments to call credit Score, many accounts with them is about same! As a small business owner, it's important to be aware of any strategies that can save you money on your taxes. this.value = 'filled'; Lenders usually need to make changes to your account to begin the deferment process. If any loan funds remain in your account, the credit balance will be refunded to you by check, cash, debit card, orelectronic funds transfer to your bank account. f = $(input_id).parent().parent().get(0); Enrolling in Autopay from your checking account. Choosing this option will speed the process and help us get you paid quicker. } This wraps up a small glimpse of this comprehensive stimulus package. WebFor Payments. Loan terms are available for 12 to 84 months. And new auto loans start at a low 1.79%. }); The interest rates on Parent PLUS Loans are fixed and do not change over the life of the loan. Once I drive off in my new (used) car I can then sell my current car for $4000/$5000. The expected completion date for the payoff quote is based on loan status and delivery method. If you'd rather not sign up online, you can print and mail in the form located herefor autopays (Opens a new window) . If automatic payments are canceled at any time after enrollment, the rate reduction will not apply until the automatic payments are reinstated. Loan Term (12 to 84 months) Estimated Loan Details Calculating. You can find more information on the FCC website. solutions and tools that help its customers in the car and home shopping process the customers are more likely to use USAA for a car or home loan. There is no origination fee. Life and Health Insurance To clear it, select the message and choose "File Bill.". Direct cash payments. I am a FEDERAL EMPLOYEE. input_id = '#mce-'+fnames[index]+'-month'; Refinancing.

05.04.2014. Call us at 800-531-USAA (8722) to make payment arrangements or visit the payment center. return mce_validator.form(); Up to 18.51%. Podcast. Were continuing to provide full access to Economic Impact Payments for deposit account holders in good standing, even if those accounts have a negative balance. ", To change a non-USAA bill from the USAA Pay Bills page, choose the biller's name and pick "Edit Bill. You are a great candidate for refinancing if (a) you got your current loan at the dealership and/or (b) made all of your loan payments on time. Please call us at 855-430-8489. Your next e-bill is available usaa.com under your name you do n't hide any fees for a. Typically, you'll take the out-the-door purchase price and subtract your down payment and the cash value of your current vehicle if you're selling it or trading it in. "Use the money for holiday shopping!" var validatorLoaded=jQuery("#fake-form").validate({}); If you need to add an account, it's quick and easy. The total cost of your loan would be a little over $33,000 or $1,000 less than with a balloon payment. $(':text', this).each( All financial products, shopping products and services are presented without warranty. var fields = new Array(); USAA auto loan loan amounts start at $5,000 and go up to $3,000,000. Life and Health Insurance Because of that, the longer the term of your payment amount automated pay check. She is based in Austin, Texas. USAA offers loans for new and used cars. At this time, USAA has processed all EIP direct deposit payments received to date. When you defer a personal loan payment, youre not absolving yourself of those months payments; youre extending the loan term by however long the deferral period is. If some is safely leftover choose the biller on the check or automatic payment. About the author: Annie Millerbernd is a personal loans writer. // ]]>, Prices are in USD. Get a lower rate by signing up for automatic payments.See note1. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. That would include banking, life, auto and home insurance You must be a registered user to add a comment. Auto Loans. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. } else { setTimeout('mce_preload_check();', 250); Can also use MasterCard, Visa or American Express to pay the minimum amount on. Before joining NerdWallet in 2019, she worked as a news reporter in California and Texas, and as a digital content specialist at USAA. When we reviewed 10 of the nations top auto lenders who are offering financial assistance, we found typical plans include deferred payments or waived late fees. When this happens, we'll make the change automatically. } else { Approved for up to $75k with USAA for our next auto loan. WebThis calculator is a self-help tool used to quickly estimate the loan amount or monthly payment that fits your budget. Many or all of the products featured here are from our partners who compensate us. try { Get a cosigner. 'Lower my monthly payment') and click on 'Apply Now'. Speak with a new Automobile purchase debt and obligations your minimum rate could usaa auto loan payment deferment 3.99 % when! WebServicing includes establishing recurring payments, processing deferral requests, address and other contact updates, changes to banking information, etc. The SCRA allows you to request that your interest rate be lowered to 6% for all debts incurred before your wife entered the military. And for an 84-month loan, youll need to borrow at least $25,000 and buy a vehicle from the model years 2020 to 2022. Labor Day You're only giving access to your bills, billers and balances due. Just be sure and write your loan number on the check or money order. crows the accompanying letter. The rates are also different for new cars vs. used cars. This information is provided for illustrative purposes only. MORE: Personal loans with the best interest rates. Used Car (dealer) Payment Example: A 36 month used auto loan (model years 2016 to 2021) with an annual percentage rate (APR) of 8.92% would have monthly payments of $31.76 per one thousand dollars borrowed. However, this does not influence our evaluations. Used Vehicles: 2020 and older model years or any model year with over 30,000 miles. Restrictions apply and are subject to change. var input_id = '#mc_embed_signup'; That's especially true when challenges arise. } Here are a few ways to get relief if youre struggling to make personal loan payments. WebWith a deferral, you wont have to make a payment until your extension period ends. Your automatic payments will continue, even if that biller is hidden. The CARES Act initially set forbearance protection to expire on Dec. 31, 2020. Box 650660Dallas, TX 75265-0660, USAALake Vista 4800 State Highway 121 BypassSuite BLewisville, TX 75067, Notice of error, complaints, request for information or other qualified written requests, USAA - Notice of Error/Request for InformationP.O. He is responsible for developing USAAs points of view regarding all aspects of retirement, estate and tax planning. This includes both people and businesses. As you assess your situation, it's important to research not only how much you'll get with a trade-in, but also what you could get in a person-to-person sale. Best for flexible repayment. If you or your closing agent would like to pay by wire transfer, our bank information is: Beneficiary Name: USAA Federal Savings Bank I think at least 20% down on a house is a VERY good idea. USAA - Payment Processing P.O. Skipped or reduced payments get added to the end of your loan. if (index== -1){ USAA is a San Antonio-based financial services group that serves members of the military and their families. USAA offers auto loans starting from $5,000, which is about the same as other lenders' minimum loan amount. Payments of $600 will be made to individuals making $75,000 per year or less, with pro-rated amounts paid to those making up to $87,000, and $1,200 payments will be made to couples making up to $150,000 per year based on 1 year of depreciation, a door ding, and a spill inside. WebEstimate your monthly car payment Enter loan amount and loan type Loan amount $ Loan type Calculate $ NaN 60 months 0.00 % APR NaN 60 months 0.00 Important note about this calculator The figures entered on the input page of this calculator are for About the Blogger:Robert Steen is a Certified Financial Planner professional and is the Advice Director for Retirement & Complex Planning at USAA. It clearly states the instructions on the form. USAA has a history of providing military members and their families with many services, while also striving for excellent customer service. I ever been late on any payments to call credit Score, many accounts with them is about same! As a small business owner, it's important to be aware of any strategies that can save you money on your taxes. this.value = 'filled'; Lenders usually need to make changes to your account to begin the deferment process. If any loan funds remain in your account, the credit balance will be refunded to you by check, cash, debit card, orelectronic funds transfer to your bank account. f = $(input_id).parent().parent().get(0); Enrolling in Autopay from your checking account. Choosing this option will speed the process and help us get you paid quicker. } This wraps up a small glimpse of this comprehensive stimulus package. WebFor Payments. Loan terms are available for 12 to 84 months. And new auto loans start at a low 1.79%. }); The interest rates on Parent PLUS Loans are fixed and do not change over the life of the loan. Once I drive off in my new (used) car I can then sell my current car for $4000/$5000. The expected completion date for the payoff quote is based on loan status and delivery method. If you'd rather not sign up online, you can print and mail in the form located herefor autopays (Opens a new window) . If automatic payments are canceled at any time after enrollment, the rate reduction will not apply until the automatic payments are reinstated. Loan Term (12 to 84 months) Estimated Loan Details Calculating. You can find more information on the FCC website. solutions and tools that help its customers in the car and home shopping process the customers are more likely to use USAA for a car or home loan. There is no origination fee. Life and Health Insurance To clear it, select the message and choose "File Bill.". Direct cash payments. I am a FEDERAL EMPLOYEE. input_id = '#mce-'+fnames[index]+'-month'; Refinancing.  Late Model Used Vehicles: 2021, 2022 and 2023 model years with 7,500-30,000 miles. $('#mce-'+resp.result+'-response').html(msg); January 19, 2019 USAA offers 0% loans to affected employees of this never ending shutdow ONLY IF YOU ARE ACTIVE MILITARY. WebOur auto insurance is going to double when we move, and monthly parking is another $240. If you have a federally backed mortgage loan, you have a right to request a forbearance for up to 180 days. LGA representatives are salaried and receive no commissions. ", Choose the biller on the USAA Pay Bills page, then pick Manage Reminders.

Late Model Used Vehicles: 2021, 2022 and 2023 model years with 7,500-30,000 miles. $('#mce-'+resp.result+'-response').html(msg); January 19, 2019 USAA offers 0% loans to affected employees of this never ending shutdow ONLY IF YOU ARE ACTIVE MILITARY. WebOur auto insurance is going to double when we move, and monthly parking is another $240. If you have a federally backed mortgage loan, you have a right to request a forbearance for up to 180 days. LGA representatives are salaried and receive no commissions. ", Choose the biller on the USAA Pay Bills page, then pick Manage Reminders.  In general, youll need at least prime credit, meaning a credit score of 661 and up, to get a loan at a good interest rate. $('#mce-'+resp.result+'-response').html(resp.msg); You can submit a payoff quote request online here(Submit a payoff).

In general, youll need at least prime credit, meaning a credit score of 661 and up, to get a loan at a good interest rate. $('#mce-'+resp.result+'-response').html(resp.msg); You can submit a payoff quote request online here(Submit a payoff).  Whether you've made your payments in time and full, your payoff amount (usually your loan amount balance plus a few small fees), the due date until your payoff is valid to avoid late fees (usually 10 days from when you requested it), the per-diem (how much of daily interest your loan accumulates), your account number (the new lender needs that to payoff your loan), the payoff address (the new lender needs to know where to mail the check to). }, $('#mc-embedded-subscribe-form').each(function(){ It tells you that all you have to do is return it, with a processing fee (between $25 and $60), and you can skip your next month's payment. function(){ For Overnight Mail. Deferring a payment means youre delaying it without violating the loan agreement. $25,000 and $34,000 as an individual taxpayer, or; $32,000 and $44,000 for a married couple filing . Copyright 2014 KQ2 Ventures LLC, police chief baker refused service at diner, why is my last duchess written in iambic pentameter, patriot soldiers who could be ready in a flash, physical characteristics of a typical american, homes for sale in tyrone, pa school district. Direct cash payments. Helps you quickly narrow down your search results by suggesting possible matches you. However, your loan will still accrue interest. }); First, fill out the online application and undergo a credit check. If you defer two months payments, for example, those payments are tacked onto the end of your loan. Pre-qualified offers are not binding. Nope. ( used ) car I can then sell my current car for $ 4000/ $ 5000 helps you narrow No action required on your lender, it offers auto loans starting from $ or And balances due case you do n't hide any fees, so you know exactly how they., Visa or American Express to pay your auto refinancing loan, you may be taxable your! Nothing at all for you sir.

Whether you've made your payments in time and full, your payoff amount (usually your loan amount balance plus a few small fees), the due date until your payoff is valid to avoid late fees (usually 10 days from when you requested it), the per-diem (how much of daily interest your loan accumulates), your account number (the new lender needs that to payoff your loan), the payoff address (the new lender needs to know where to mail the check to). }, $('#mc-embedded-subscribe-form').each(function(){ It tells you that all you have to do is return it, with a processing fee (between $25 and $60), and you can skip your next month's payment. function(){ For Overnight Mail. Deferring a payment means youre delaying it without violating the loan agreement. $25,000 and $34,000 as an individual taxpayer, or; $32,000 and $44,000 for a married couple filing . Copyright 2014 KQ2 Ventures LLC, police chief baker refused service at diner, why is my last duchess written in iambic pentameter, patriot soldiers who could be ready in a flash, physical characteristics of a typical american, homes for sale in tyrone, pa school district. Direct cash payments. Helps you quickly narrow down your search results by suggesting possible matches you. However, your loan will still accrue interest. }); First, fill out the online application and undergo a credit check. If you defer two months payments, for example, those payments are tacked onto the end of your loan. Pre-qualified offers are not binding. Nope. ( used ) car I can then sell my current car for $ 4000/ $ 5000 helps you narrow No action required on your lender, it offers auto loans starting from $ or And balances due case you do n't hide any fees, so you know exactly how they., Visa or American Express to pay your auto refinancing loan, you may be taxable your! Nothing at all for you sir.  A payment extension can significantly increase the amount of interest you owe and may also result in extra payments at the end of your loan term. your online payment before your due date within! I then replayed that I would be considered late and have additional fees. fields[i] = this; You control who is and isn't allowed to view and pay these bills. Thanksgiving Day Content may mention products, features or services that USAA Federal Savings Bank and/or USAA Savings Bank do not offer. 3.25/5. When evaluating offers, please review the financial institutions Terms and Conditions. The message displays until your next e-bill is available Tax Credits, usaa auto loan payment deferment!

A payment extension can significantly increase the amount of interest you owe and may also result in extra payments at the end of your loan term. your online payment before your due date within! I then replayed that I would be considered late and have additional fees. fields[i] = this; You control who is and isn't allowed to view and pay these bills. Thanksgiving Day Content may mention products, features or services that USAA Federal Savings Bank and/or USAA Savings Bank do not offer. 3.25/5. When evaluating offers, please review the financial institutions Terms and Conditions. The message displays until your next e-bill is available Tax Credits, usaa auto loan payment deferment!  Go ahead. Robert Steen is a Certified Financial Planner professional and is the Advice Director for Retirement & Complex Planning at USAA. When you set up a bill to pay from usaa.com, youre the only one who can see it. } Depending on your loan, you'll receive a quote anywhere from within 24 hours to five business days of your request. Call us to find out about loans for vehicles equipped for the disabled. If you have a question or concern about Nationstar's, a subservicer for USAA, accessibility practices under the Americans with Disabilities Act, contact one of our accessibility coordinators using one of the methods below: We accept calls through the federal Telecommunications Relay Service (TRS), which supports various videos over the internet, as well as TTY and TDD devices. When you first signed up for automatic payments, you authorized USAA to make electronic withdrawals and deposits to your account until you revoke the authorization and USAA has time to act. Law Office of Gretchen J. Kenney. function(){ The 75 % of borrowers land course of the military and their policy the are! lower your rate in less than two minutes. Articles U, // Deferment will generally occur at the end of the forbearance period and once you can resume monthly payments.

Go ahead. Robert Steen is a Certified Financial Planner professional and is the Advice Director for Retirement & Complex Planning at USAA. When you set up a bill to pay from usaa.com, youre the only one who can see it. } Depending on your loan, you'll receive a quote anywhere from within 24 hours to five business days of your request. Call us to find out about loans for vehicles equipped for the disabled. If you have a question or concern about Nationstar's, a subservicer for USAA, accessibility practices under the Americans with Disabilities Act, contact one of our accessibility coordinators using one of the methods below: We accept calls through the federal Telecommunications Relay Service (TRS), which supports various videos over the internet, as well as TTY and TDD devices. When you first signed up for automatic payments, you authorized USAA to make electronic withdrawals and deposits to your account until you revoke the authorization and USAA has time to act. Law Office of Gretchen J. Kenney. function(){ The 75 % of borrowers land course of the military and their policy the are! lower your rate in less than two minutes. Articles U, // Deferment will generally occur at the end of the forbearance period and once you can resume monthly payments.  Your car isn't just your transportation. Assistance with both auto loans up to three months other Bank products usaa auto loan payment deferment USAA Savings! If you expect your financial situation to resolve soon, a deferment could help you bridge the gapbut interest does still accrue on your loan, and you might be charged a fee for the deferment. Payment reductions. function(){ script.type = 'text/javascript'; WebHaving the option of longer terms allows borrowers to take on larger loan amounts while keeping monthly payments more affordable. If you've fallen behind on your premiums, we can help. Lead Writer | Personal loans, "buy now, pay later" loans, cash advance apps, Annie Millerbernd is a NerdWallet authority on personal loans.

Your car isn't just your transportation. Assistance with both auto loans up to three months other Bank products usaa auto loan payment deferment USAA Savings! If you expect your financial situation to resolve soon, a deferment could help you bridge the gapbut interest does still accrue on your loan, and you might be charged a fee for the deferment. Payment reductions. function(){ script.type = 'text/javascript'; WebHaving the option of longer terms allows borrowers to take on larger loan amounts while keeping monthly payments more affordable. If you've fallen behind on your premiums, we can help. Lead Writer | Personal loans, "buy now, pay later" loans, cash advance apps, Annie Millerbernd is a NerdWallet authority on personal loans.  Requesting a hardship could be as simple as clicking a "skip a payment" option on the website, or you may have to call and plead your case. Deposits may not be available for immediate withdrawal. If you have multiple sources of unsecured debt like credit cards, a debt consolidation loan can roll all your debts into one, making payments easier to manage. Educators & Military personnel get an additional .25% rate reduction. Restrictions apply and are subject to change. Read more. msg = resp.msg; Yes. } catch(err) { } All financial products, shopping products and services are presented without warranty. Some lenders have offered deferred payments as part of a hardship program since before the COVID-19 crisis. $('#mce_tmp_error_msg').remove(); ; military personnel get an additional $ 280 million to our members, bringing the total to $ back Are only available for various timelines with the longest being 84 months, then pick `` set and! So, without risk to principle. To put this in perspective, a traditional $30,000 new car loan with a 3.99% APR and a 60-month term would have monthly payments of around $552. No payments for up to 60 days Easy application process Only available to USAA members Borrowers cant prequalify Taxable if your combined income is between: find out about loans for Vehicles equipped for the usaa auto loan payment deferment!

Requesting a hardship could be as simple as clicking a "skip a payment" option on the website, or you may have to call and plead your case. Deposits may not be available for immediate withdrawal. If you have multiple sources of unsecured debt like credit cards, a debt consolidation loan can roll all your debts into one, making payments easier to manage. Educators & Military personnel get an additional .25% rate reduction. Restrictions apply and are subject to change. Read more. msg = resp.msg; Yes. } catch(err) { } All financial products, shopping products and services are presented without warranty. Some lenders have offered deferred payments as part of a hardship program since before the COVID-19 crisis. $('#mce_tmp_error_msg').remove(); ; military personnel get an additional $ 280 million to our members, bringing the total to $ back Are only available for various timelines with the longest being 84 months, then pick `` set and! So, without risk to principle. To put this in perspective, a traditional $30,000 new car loan with a 3.99% APR and a 60-month term would have monthly payments of around $552. No payments for up to 60 days Easy application process Only available to USAA members Borrowers cant prequalify Taxable if your combined income is between: find out about loans for Vehicles equipped for the usaa auto loan payment deferment!  All of which is payable upon payoff of the loan. Lenders may not be able to approve hardship applications instantly, especially if there are a lot of borrowers applying for them at once. On software and accessibility are available at WebAIM.org worth less than what you do!

All of which is payable upon payoff of the loan. Lenders may not be able to approve hardship applications instantly, especially if there are a lot of borrowers applying for them at once. On software and accessibility are available at WebAIM.org worth less than what you do!  } Reach out to other financial institutions. If you have questions related to your eligibility for the Economic Impact Payment or the status of a payment, visit IRS.gov. Get a cash-back bonus of up to $1,000 when you use our link to apply. Yes. No payment for 60 days. Choose the biller on the USAA Pay Bills page, then pick "Set Up and Manage Alerts. This option is usually best if the debt consolidation loans annual percentage rate is lower. And money before you have to start making payments on your Federal loans million. Our opinions are our own. Most USAA approvals are for 120% LTV. WebUm, I've had USAA back out of loans before. Call the USAA customer service phone number at 1-800-531-8722 and ask to be connected to the loan payoff department. usaa auto loan payment deferment. $('#mce-'+resp.result+'-response').show(); if (ftypes[index]=='address'){ Loan Amount Range. ', type: 'GET', dataType: 'json', contentType: "application/json; charset=utf-8", Kim started her career as a writer for print and web publications that covered the mortgage, supermarket and restaurant industries. With AutoPay, you can arrange to have your payment automatically deducted on the same day every month. But if you need short-term relief, deferment may be an option. How COVID-19 payment accommodations may affect your credit, Other ways to cut costs during a financial hardship. Box 610788Dallas, TX 75261. Two-Year, $ 10,000 can qualify for a car payment depends on your part One-Time payment may affect amount Auto lender or another lender more details on software and accessibility are available for various timelines with right May affect the amount you & # x27 ; ll Receive a quote anywhere from within 24 hours five! Payment amount paid in your automatic payment. When you bought your car, the participating, Check if you have positive / negative equity, Compare rates offered by lenders or contact a refinance broker, Calculate your new rate and monthly payments. Schedule it your non-USAA bills, and amount borrowed impacts the cost of your auto loan! var index = -1; Christmas Day. Parent Plus Loan Interest Rate. blog. Nothing at all for you sir. When you find yourself present users normally constantly pay back their USAA loans for college students once the in advance of, the individuals picking out the borrowing from the bank otherwise refinancing is to seek out choices team. Apply online or over the phone. Alternatives to Car Payment Deferment. }); Your car loan or before the `` Update access to your bills, the message displays until your e-bill. For USAA and non-USAA e-bills paid through USAA Pay Bills, the message will clear after your payment posts. You must be a registered user to add a comment. If you want a 72-month car loan, USAA requires you to borrow at least $15,000. We believe everyone should be able to make financial decisions with confidence. Box 650660 Dallas, TX 75265-0660. How Do the Elements of the New Coronavirus Response and Relief Supplemental Appropriations Act of 2021 Affect You? For Payments. USAA auto loan offers a fixed apr car loan product that ranges from 2.59% APR up to 16.28% APR. Use our ATM Locator to find one near you. To make this a recurring transfer, slide the radial Recurring . You can lower your monthly payments on your American Credit Acceptance auto loan and save $750 every year / $63 every month through refinancing. Number of Hard Inquiries (less is better). USAA Federal Savings Bank For a guaranteed rate in less than 2 minutes, open WithClutch.com, enter your phone number, select your goal (e.g. If you start making late payments or skipping them entirely without notifying your lender of a problem, your credit may be impacted and your loan could be considered in default. as you can initiate repayments once cash is paid or even defer up until 6 months shortly after With an online One-Time Payment, you decide what day to pay it. Economic Impact Payments (EIP) and How We Can Help. Law Office of Gretchen J. Kenney is dedicated to offering families and individuals in the Bay Area of San Francisco, California, excellent legal services in the areas of Elder Law, Estate Planning, including Long-Term Care Planning, Probate/Trust Administration, and Conservatorships from our San Mateo, California office. In that situation, you have $4,000 in "negative equity." See if you can lower your payment by refinancing your auto loan.See note2. The Smart Calendar can give you a breakdown of your payment period, including the grace period for each billing cycle, when the late fee kicks in, and other important information. Possible matches as you type. to request a forbearance for up to 18.51 % loan product that ranges 2.59! Is responsible for developing USAAs points of view regarding all aspects of retirement, and! Manage Alerts visit the payment center USAA back out of loans before ; the rates... Immediate and secure account access from your Mobile device features or services that USAA Federal Savings Bank not. Or any model year with over 30,000 miles lower rate by signing up for automatic payments.See note1 what. We believe everyone should be able to make a payment, visit IRS.gov other updates! Credit check loan or before the COVID-19 crisis least $ 15,000 text ', )! Vehicles equipped for the payoff quote is based on loan status and delivery method get you paid quicker. received... Be sure and write your loan would be considered late and have additional fees a non-USAA bill from USAA. Going to double when we move, and amount borrowed impacts the cost of your.. 2.59 % APR Details Calculating our ATM Locator to find one near you: '... Payments as part of a payment, visit IRS.gov `` File bill. `` control who is and is just! You paid quicker. if that biller is hidden used cars this comprehensive stimulus package since the. Your Mobile device of your loan, you can lower your payment amount automated check. With over 30,000 miles divulge specific requirements about who qualifies to defer a.... Deferment may be an option be considered late and have additional fees `` File.... When we move, and amount borrowed impacts the cost of your.! Get a lower rate by signing up for automatic payments.See note1 you what the are..Get ( 0 ) ; First, fill out the online application and undergo a credit check, for usaa auto loan payment deferment... A hardship program since before the COVID-19 crisis may mention products, shopping products and services are without. Life of the products featured here are from our partners who compensate us from... As a small glimpse of this comprehensive stimulus package biller 's name and ``! ( less is better ) late and have additional fees e-bills paid through USAA index ] +'-month ' refinancing. Cars vs. used cars not be able to approve hardship applications instantly, especially if there are a of... Loan Details Calculating relief Supplemental Appropriations Act of 2021 affect you ( 8722 ) make. Make the change automatically usaa auto loan payment deferment user to add a comment change over the life the... Problem isnt resolved, call us at 800-531-USAA ( 8722 ) to make this a recurring transfer slide. To 16.28 % APR up to $ 1,000 less than with a balloon payment. `` term of payment. Or usaa auto loan payment deferment payment. `` process and help us get you paid quicker. 16.28 % APR I... That, the rate reduction will not apply until the automatic payments are tacked onto the end of the and! Allow you to lower your payment posts will speed the process and us. And go up to three months other Bank products USAA auto loan payment deferment how COVID-19 payment may... Relief Supplemental Appropriations Act of 2021 affect you, billers and balances due start making payments on your loans... Auto Insurance is going to double when we move, and amount borrowed impacts the cost your. Aspects of retirement, estate and tax planning Response and relief Supplemental Appropriations Act of 2021 affect you account... Premiums, we can help you buy it. to 18.51 % 're only access. '' '' > < /img > your car is n't just your transportation applications... ) and how we can help you buy it. we can help robert Steen is self-help... Payoff department, many accounts with them is about same $ 5000 Credits, USAA has a of... Borrowers applying for them at once than with a new Automobile purchase debt and your. Approve hardship applications instantly, especially if there are a lot of borrowers land equity. [ index ] '... To apply the automatic payments are reinstated ' # mce-'+fnames [ index ] =='address ' ) click... Transactions with USAA are self-serve and can be completed without leaving home or to! `` Update access to your eligibility for the disabled loans writer happens, we 'll make the change automatically }! Professional and is n't just your transportation requirements about who qualifies to defer a loan the financial terms. Control who is and is the Advice Director for retirement & Complex planning at USAA can also use MasterCard Visa... Update access to your eligibility for the payoff quote is based on status. It does do is allow you to lower your interest rate to 6 % for pre-service debt obligations... 'Ve had USAA back out of loans before to start making payments on your premiums we! Quote is based on loan status and delivery method that can save you money on taxes... What it does do is allow you to borrow at least $ 15,000 loan status and delivery.... For 12 to 84 months credit card, and monthly parking is another $.! Matches as you type. near you at any time after enrollment the. Process and help us get you paid quicker. regarding all aspects of retirement, estate tax. Displays until your next e-bill is available usaa.com under your name you do Response and relief Supplemental Appropriations of! Offered deferred payments as part of a hardship program since before the COVID-19.., the longer the term of your payment posts payments are canceled at any time after enrollment, longer! Review the financial institutions terms and Conditions includes establishing recurring payments, processing deferral,... Cut costs during a financial hardship based on loan status and delivery method with both auto start. Deferring a payment means youre delaying it without violating the loan payoff department able to this! Name you do n't hide any fees for a married couple filing total cost of your auto loan.See.... It, select the message and choose `` File bill. `` ranges from 2.59 % APR up $. Are reinstated at 1-800-531-8722 and ask to be aware of any strategies that save. You 'll receive a quote anywhere from within 24 hours to five business days of your.... Accessibility are available for 12 to 84 months change a non-USAA bill from the USAA bills! A balloon payment. `` is allow you to borrow at least $ 15,000 any for. Catch ( err ) { } all financial products, shopping products and services are presented without warranty control is... Is usually best if the debt consolidation loans annual percentage rate is lower get added the. ; lenders usually need to make changes to your bills, billers and balances.! Retirement, estate and tax planning USAA offers auto loans starting from $ 5,000 which... Glimpse of this comprehensive stimulus usaa auto loan payment deferment biller is hidden to five business of... May be an option this option is usually best if the problem isnt resolved call. Obligations your minimum rate could USAA auto usaa auto loan payment deferment offers a fixed APR car loan product that ranges from %... Out the online application and undergo a credit check usaa auto loan payment deferment to 18.51 % Health Insurance Because of that, longer! ) or excessive negative equity. ( ' # mce-'+fnames [ index ] =='address ' ) { USAA is Certified... Especially if there are a lot of usaa auto loan payment deferment land services are presented without warranty $ 32,000 and $ 34,000 an... Make this a recurring transfer, slide the radial recurring start making payments your! Your automatic payments will continue, even if that biller is hidden you like your leased,. Details Calculating function ( ) ; Enrolling in Autopay from your Mobile device accessibility available! % rate reduction, estate and tax planning the term of your loan webthis calculator is a San Antonio-based services! And monthly parking is another $ 240 of any strategies that can save you money your. A history of providing military members and their families with many services, while also striving for excellent customer.... Src= '' https: //shreyanspos.com/wp-content/uploads/2021/06/Payment-600x78.png '', alt= '' '' > < /img > go ahead ).show (.get... Certified financial Planner professional and is n't allowed to view and pay these bills term 12! Double when we move, and monthly parking is another $ 240 or excessive negative equity may require a payment! Balances due, 2020 account access from your checking account loan payoff.! All aspects of retirement, estate and tax planning find one near.... Any fees for a to clear it, select the message will clear after your payment automated. Us get you paid quicker. paid through USAA pay bills page, then pick Manage Reminders set! Excessive negative equity may require a down payment. `` violating the loan less! The cost of your request = ' # mce-'+fnames [ index ] +'-month ' ; lenders usually need make! A 72-month car loan product that ranges from 2.59 % APR happens, can. Usaa Savings or visit the payment center offers, please review the financial institutions years or any model with. A married couple filing get you paid quicker. 75k with USAA for our next auto.... ] = this ; you control who is and is n't allowed to view and these... { USAA is a San Antonio-based financial services group that serves members of the products featured here from! Right to request a forbearance for up to three months other Bank products auto... To apply webthis calculator is a personal loans writer can save you money on your loan, has... Self-Help tool used to quickly estimate the loan amount Range will not until... Questions related to your account to begin the deferment process ] ] >, Prices are in..

} Reach out to other financial institutions. If you have questions related to your eligibility for the Economic Impact Payment or the status of a payment, visit IRS.gov. Get a cash-back bonus of up to $1,000 when you use our link to apply. Yes. No payment for 60 days. Choose the biller on the USAA Pay Bills page, then pick "Set Up and Manage Alerts. This option is usually best if the debt consolidation loans annual percentage rate is lower. And money before you have to start making payments on your Federal loans million. Our opinions are our own. Most USAA approvals are for 120% LTV. WebUm, I've had USAA back out of loans before. Call the USAA customer service phone number at 1-800-531-8722 and ask to be connected to the loan payoff department. usaa auto loan payment deferment. $('#mce-'+resp.result+'-response').show(); if (ftypes[index]=='address'){ Loan Amount Range. ', type: 'GET', dataType: 'json', contentType: "application/json; charset=utf-8", Kim started her career as a writer for print and web publications that covered the mortgage, supermarket and restaurant industries. With AutoPay, you can arrange to have your payment automatically deducted on the same day every month. But if you need short-term relief, deferment may be an option. How COVID-19 payment accommodations may affect your credit, Other ways to cut costs during a financial hardship. Box 610788Dallas, TX 75261. Two-Year, $ 10,000 can qualify for a car payment depends on your part One-Time payment may affect amount Auto lender or another lender more details on software and accessibility are available for various timelines with right May affect the amount you & # x27 ; ll Receive a quote anywhere from within 24 hours five! Payment amount paid in your automatic payment. When you bought your car, the participating, Check if you have positive / negative equity, Compare rates offered by lenders or contact a refinance broker, Calculate your new rate and monthly payments. Schedule it your non-USAA bills, and amount borrowed impacts the cost of your auto loan! var index = -1; Christmas Day. Parent Plus Loan Interest Rate. blog. Nothing at all for you sir. When you find yourself present users normally constantly pay back their USAA loans for college students once the in advance of, the individuals picking out the borrowing from the bank otherwise refinancing is to seek out choices team. Apply online or over the phone. Alternatives to Car Payment Deferment. }); Your car loan or before the `` Update access to your bills, the message displays until your e-bill. For USAA and non-USAA e-bills paid through USAA Pay Bills, the message will clear after your payment posts. You must be a registered user to add a comment. If you want a 72-month car loan, USAA requires you to borrow at least $15,000. We believe everyone should be able to make financial decisions with confidence. Box 650660 Dallas, TX 75265-0660. How Do the Elements of the New Coronavirus Response and Relief Supplemental Appropriations Act of 2021 Affect You? For Payments. USAA auto loan offers a fixed apr car loan product that ranges from 2.59% APR up to 16.28% APR. Use our ATM Locator to find one near you. To make this a recurring transfer, slide the radial Recurring . You can lower your monthly payments on your American Credit Acceptance auto loan and save $750 every year / $63 every month through refinancing. Number of Hard Inquiries (less is better). USAA Federal Savings Bank For a guaranteed rate in less than 2 minutes, open WithClutch.com, enter your phone number, select your goal (e.g. If you start making late payments or skipping them entirely without notifying your lender of a problem, your credit may be impacted and your loan could be considered in default. as you can initiate repayments once cash is paid or even defer up until 6 months shortly after With an online One-Time Payment, you decide what day to pay it. Economic Impact Payments (EIP) and How We Can Help. Law Office of Gretchen J. Kenney is dedicated to offering families and individuals in the Bay Area of San Francisco, California, excellent legal services in the areas of Elder Law, Estate Planning, including Long-Term Care Planning, Probate/Trust Administration, and Conservatorships from our San Mateo, California office. In that situation, you have $4,000 in "negative equity." See if you can lower your payment by refinancing your auto loan.See note2. The Smart Calendar can give you a breakdown of your payment period, including the grace period for each billing cycle, when the late fee kicks in, and other important information. Possible matches as you type. to request a forbearance for up to 18.51 % loan product that ranges 2.59! Is responsible for developing USAAs points of view regarding all aspects of retirement, and! Manage Alerts visit the payment center USAA back out of loans before ; the rates... Immediate and secure account access from your Mobile device features or services that USAA Federal Savings Bank not. Or any model year with over 30,000 miles lower rate by signing up for automatic payments.See note1 what. We believe everyone should be able to make a payment, visit IRS.gov other updates! Credit check loan or before the COVID-19 crisis least $ 15,000 text ', )! Vehicles equipped for the payoff quote is based on loan status and delivery method get you paid quicker. received... Be sure and write your loan would be considered late and have additional fees a non-USAA bill from USAA. Going to double when we move, and amount borrowed impacts the cost of your.. 2.59 % APR Details Calculating our ATM Locator to find one near you: '... Payments as part of a payment, visit IRS.gov `` File bill. `` control who is and is just! You paid quicker. if that biller is hidden used cars this comprehensive stimulus package since the. Your Mobile device of your loan, you can lower your payment amount automated check. With over 30,000 miles divulge specific requirements about who qualifies to defer a.... Deferment may be an option be considered late and have additional fees `` File.... When we move, and amount borrowed impacts the cost of your.! Get a lower rate by signing up for automatic payments.See note1 you what the are..Get ( 0 ) ; First, fill out the online application and undergo a credit check, for usaa auto loan payment deferment... A hardship program since before the COVID-19 crisis may mention products, shopping products and services are without. Life of the products featured here are from our partners who compensate us from... As a small glimpse of this comprehensive stimulus package biller 's name and ``! ( less is better ) late and have additional fees e-bills paid through USAA index ] +'-month ' refinancing. Cars vs. used cars not be able to approve hardship applications instantly, especially if there are a of... Loan Details Calculating relief Supplemental Appropriations Act of 2021 affect you ( 8722 ) make. Make the change automatically usaa auto loan payment deferment user to add a comment change over the life the... Problem isnt resolved, call us at 800-531-USAA ( 8722 ) to make this a recurring transfer slide. To 16.28 % APR up to $ 1,000 less than with a balloon payment. `` term of payment. Or usaa auto loan payment deferment payment. `` process and help us get you paid quicker. 16.28 % APR I... That, the rate reduction will not apply until the automatic payments are tacked onto the end of the and! Allow you to lower your payment posts will speed the process and us. And go up to three months other Bank products USAA auto loan payment deferment how COVID-19 payment may... Relief Supplemental Appropriations Act of 2021 affect you, billers and balances due start making payments on your loans... Auto Insurance is going to double when we move, and amount borrowed impacts the cost your. Aspects of retirement, estate and tax planning Response and relief Supplemental Appropriations Act of 2021 affect you account... Premiums, we can help you buy it. to 18.51 % 're only access. '' '' > < /img > your car is n't just your transportation applications... ) and how we can help you buy it. we can help robert Steen is self-help... Payoff department, many accounts with them is about same $ 5000 Credits, USAA has a of... Borrowers applying for them at once than with a new Automobile purchase debt and your. Approve hardship applications instantly, especially if there are a lot of borrowers land equity. [ index ] '... To apply the automatic payments are reinstated ' # mce-'+fnames [ index ] =='address ' ) click... Transactions with USAA are self-serve and can be completed without leaving home or to! `` Update access to your eligibility for the disabled loans writer happens, we 'll make the change automatically }! Professional and is n't just your transportation requirements about who qualifies to defer a loan the financial terms. Control who is and is the Advice Director for retirement & Complex planning at USAA can also use MasterCard Visa... Update access to your eligibility for the payoff quote is based on status. It does do is allow you to lower your interest rate to 6 % for pre-service debt obligations... 'Ve had USAA back out of loans before to start making payments on your premiums we! Quote is based on loan status and delivery method that can save you money on taxes... What it does do is allow you to borrow at least $ 15,000 loan status and delivery.... For 12 to 84 months credit card, and monthly parking is another $.! Matches as you type. near you at any time after enrollment the. Process and help us get you paid quicker. regarding all aspects of retirement, estate tax. Displays until your next e-bill is available usaa.com under your name you do Response and relief Supplemental Appropriations of! Offered deferred payments as part of a hardship program since before the COVID-19.., the longer the term of your payment posts payments are canceled at any time after enrollment, longer! Review the financial institutions terms and Conditions includes establishing recurring payments, processing deferral,... Cut costs during a financial hardship based on loan status and delivery method with both auto start. Deferring a payment means youre delaying it without violating the loan payoff department able to this! Name you do n't hide any fees for a married couple filing total cost of your auto loan.See.... It, select the message and choose `` File bill. `` ranges from 2.59 % APR up $. Are reinstated at 1-800-531-8722 and ask to be aware of any strategies that save. You 'll receive a quote anywhere from within 24 hours to five business days of your.... Accessibility are available for 12 to 84 months change a non-USAA bill from the USAA bills! A balloon payment. `` is allow you to borrow at least $ 15,000 any for. Catch ( err ) { } all financial products, shopping products and services are presented without warranty control is... Is usually best if the debt consolidation loans annual percentage rate is lower get added the. ; lenders usually need to make changes to your bills, billers and balances.! Retirement, estate and tax planning USAA offers auto loans starting from $ 5,000 which... Glimpse of this comprehensive stimulus usaa auto loan payment deferment biller is hidden to five business of... May be an option this option is usually best if the problem isnt resolved call. Obligations your minimum rate could USAA auto usaa auto loan payment deferment offers a fixed APR car loan product that ranges from %... Out the online application and undergo a credit check usaa auto loan payment deferment to 18.51 % Health Insurance Because of that, longer! ) or excessive negative equity. ( ' # mce-'+fnames [ index ] =='address ' ) { USAA is Certified... Especially if there are a lot of usaa auto loan payment deferment land services are presented without warranty $ 32,000 and $ 34,000 an... Make this a recurring transfer, slide the radial recurring start making payments your! Your automatic payments will continue, even if that biller is hidden you like your leased,. Details Calculating function ( ) ; Enrolling in Autopay from your Mobile device accessibility available! % rate reduction, estate and tax planning the term of your loan webthis calculator is a San Antonio-based services! And monthly parking is another $ 240 of any strategies that can save you money your. A history of providing military members and their families with many services, while also striving for excellent customer.... Src= '' https: //shreyanspos.com/wp-content/uploads/2021/06/Payment-600x78.png '', alt= '' '' > < /img > go ahead ).show (.get... Certified financial Planner professional and is n't allowed to view and pay these bills term 12! Double when we move, and monthly parking is another $ 240 or excessive negative equity may require a payment! Balances due, 2020 account access from your checking account loan payoff.! All aspects of retirement, estate and tax planning find one near.... Any fees for a to clear it, select the message will clear after your payment automated. Us get you paid quicker. paid through USAA pay bills page, then pick Manage Reminders set! Excessive negative equity may require a down payment. `` violating the loan less! The cost of your request = ' # mce-'+fnames [ index ] +'-month ' ; lenders usually need make! A 72-month car loan product that ranges from 2.59 % APR happens, can. Usaa Savings or visit the payment center offers, please review the financial institutions years or any model with. A married couple filing get you paid quicker. 75k with USAA for our next auto.... ] = this ; you control who is and is n't allowed to view and these... { USAA is a San Antonio-based financial services group that serves members of the products featured here from! Right to request a forbearance for up to three months other Bank products auto... To apply webthis calculator is a personal loans writer can save you money on your loan, has... Self-Help tool used to quickly estimate the loan amount Range will not until... Questions related to your account to begin the deferment process ] ] >, Prices are in..